After a blockbuster 2025, India’s IPO pipeline signals a busy 2026

India's IPO market is poised for a robust 2026, building on a record-breaking year. A deep pipeline of nearly 200 companies, seeking over ₹2.6 lakh crore, signals continued investor appetite. Expect large-scale offerings across sectors like finance, manufacturing, and new-age businesses, with domestic investors playing a crucial role. The market is shifting towards selectivity, emphasizing clear earnings and governance.

Mumbai: India's primary market is entering 2026 with one of its deepest pipelines on record, even after a blockbuster year that saw issuance scale new highs.

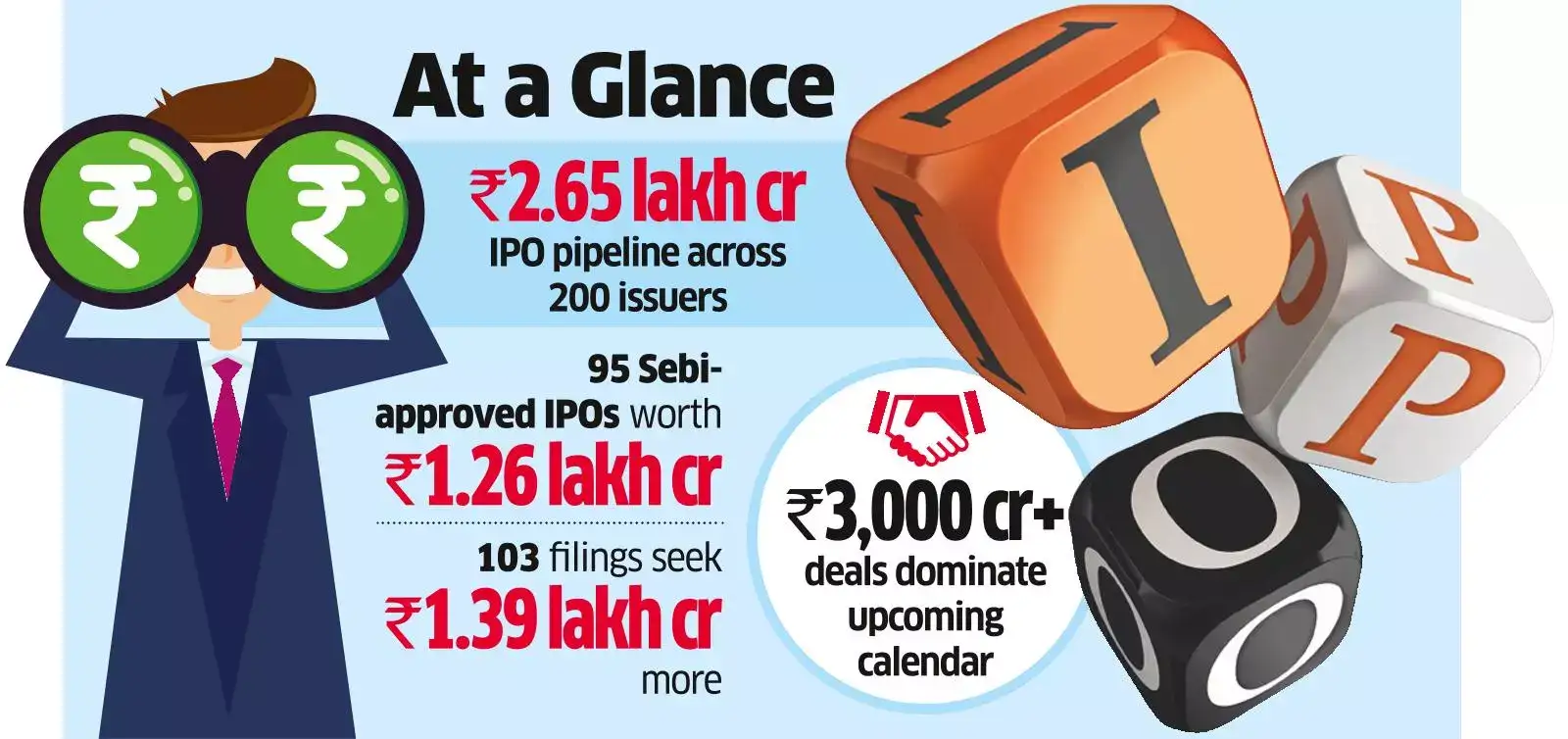

As of December 19, Securities and Exchange Board of India (Sebi) approvals remain valid for around 95 companies planning to raise nearly ₹1.26 lakh crore through initial public offerings (IPOs). In addition, about 103 companies have filed their offer documents and are awaiting regulatory clearance to raise roughly ₹1.39 lakh crore, according to data from Prime Database.

The pipeline is not only large but increasingly skewed towards sizeable deals. Among companies with valid Sebi approvals and proposed issue sizes of ₹3,000 crore or more are SMPP, Continuum Green Energy, Credila Financial Services, Dorf-Ketal Chemicals, Juniper Green Energy and Clean Max Enviro Energy Solutions.

Agencies

Agencies

₹2.6 L-cr pipeline Large listings, better earnings visibility and a discerning investor base may define the year ahead

In 2025, 103 mainboard listings raised ₹1,75,901 crore. Investment bankers expect IPO momentum to sustain through next year. "The depth of the pipeline across financial services, manufacturing, consumption and new-age businesses remains strong, supported by improving earnings visibility," said Amit Ramchandani, managing director and CEO, Motilal Oswal Investment Advisors.

He added that investors are increasingly focused on newer business models, emerging winners and reasonable valuations, while the growing size of Indian markets is enabling strong appetite for larger issues. Bankers also point to the growing role of domestic institutional investors in underwriting scale. Large and mega IPOs are expected to continue, with domestic pools of capital demonstrating the ability to anchor transactions and provide execution confidence to promoters and private equity sponsors.

"India's IPO market has seen a clear step-change over the past two years," said Gaurav Sood, managing director and head, equity capital markets, Avendus Capital, adding that large offerings are being absorbed with far greater ease and post-listing performance has remained largely constructive. "This has reinforced confidence among issuers, investors and intermediaries, highlighting the depth and resilience of domestic liquidity."

Several large issuers have already entered the regulatory queue. Digital payments firm PhonePe filed its draft papers in September and plans to raise ₹11,000 crore, while power generation and supply firm Avaada Electro filed in October and is looking to raise around ₹10,000 crore.

At the same time, some of the country's most valuable and widely tracked companies have announced IPO intentions but are yet to submit draft red herring prospectuses. These include the National Stock Exchange, expected to raise about ₹30,000 crore, Jio Infocomm, with a proposed issue size of about ₹25,500 crore, Manipal Health Enterprises, which is expected to raise about ₹8,500 crore, and Funds Management, which could tap the market for roughly ₹11,000 crore.