Bots, banking and Stablecoins will dominate fintech this year

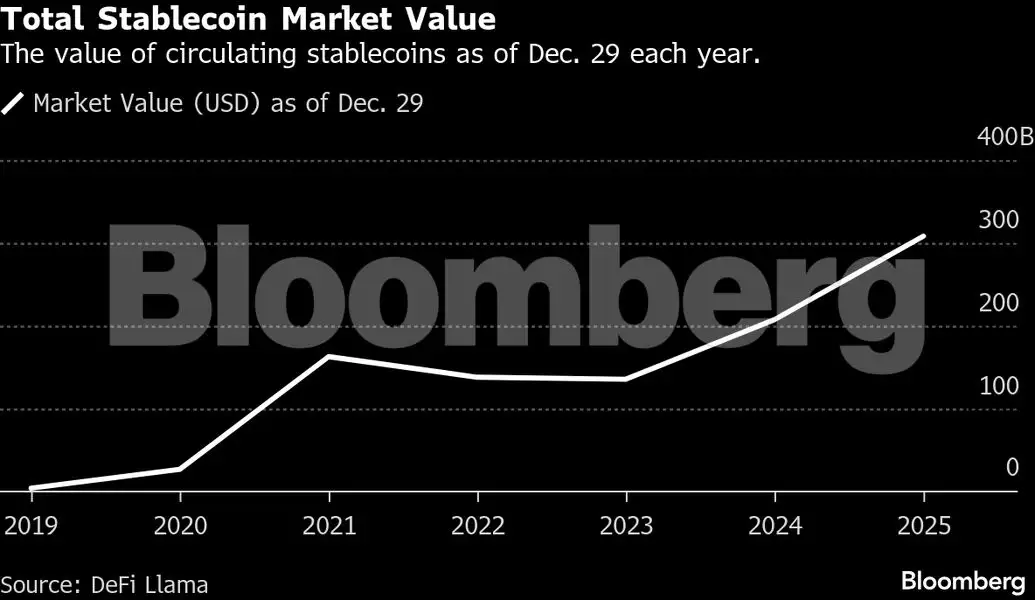

Fintech firms are strategically integrating into the US banking system, seeking national charters and direct access to payment rails. Stablecoins are poised for significant growth as major payment networks adopt them for faster, cheaper transactions. AI agents are also set to revolutionize commerce, handling research, negotiation, and purchases autonomously for consumers.

Synopsis

Fintech firms are strategically integrating into the US banking system, seeking national charters and direct access to payment rails. Stablecoins are poised for significant growth as major payment networks adopt them for faster, cheaper transactions. AI agents are also set to revolutionize commerce, handling research, negotiation, and purchases autonomously for consumers.

Agencies

Agencies

Industry leaders are betting that 2026 could mark an inflection point as bank charters, blockchain rails and autonomous payments converge

The crypto wins many predicted for 2025 didn't fully materialise. But while Bitcoin is ending the year in the red, firms across the broader digital-finance landscape have been making a methodical push into the heart of the US banking system.

After a year of regulatory triumphs, industry leaders are betting that 2026 could mark a major inflection point. Crypto firms are trading state licences for national charters, payments giants are rewiring their rails for blockchain settlement, and artificial intelligence agents are inching closer to autonomous payments.

The fintech industry's ambitious vision for the future of finance still faces hurdles, with congressional haggling over the details of crypto regulation spilling into next year. But with the White House in their corner, fintechs are riding a rare bit of momentum in Washington.

Crypto Tracker

TOP COINS (₹)

77,828 (0.87%)

267,698 (0.68%)

90 (0.19%)

7,885,746 (-0.44%)

166 (-1.48%)

Here's what executives, investors and policymakers expect in 2026.

Everything Is a Bank

One of the clearest paths for fintech firms to boost margins next year is by cutting out the middlemen. To gain access to the Fed's core payment systems and take deposits, cryptocurrency exchanges and neobanks must rely on licensed banks-unless they have their own charter. Now fintechs are lining up to get one.

Under the regulatory about-face of the crypto-friendly Trump administration, preliminary bank charter approvals have been granted to five crypto companies, including Circle Internet Group and Ripple Labs. Crypto exchange Coinbase Global has its own application, as do online payments giant PayPal and neobank operator Mercury Technologies.

The rewards are potentially significant. Federal Reserve governor Christopher Waller floated the possibility of a "skinny" master account, which would grant these firms direct access to federal payment rails like the automated clearing house and Fedwire networks.

Bloomberg

Bloomberg