Chinese memory maker CXMT prepares $4.2 billion USD IPO to take advantage of tight memory market — company lays out path to profitability as DRAM demand skyrockets worldwide

Chinese memory maker CXMT prepares to file for IPO in Beijing, aiming to raise $4.2 billion USD in order to expand production and fund next-gen DRAM development.

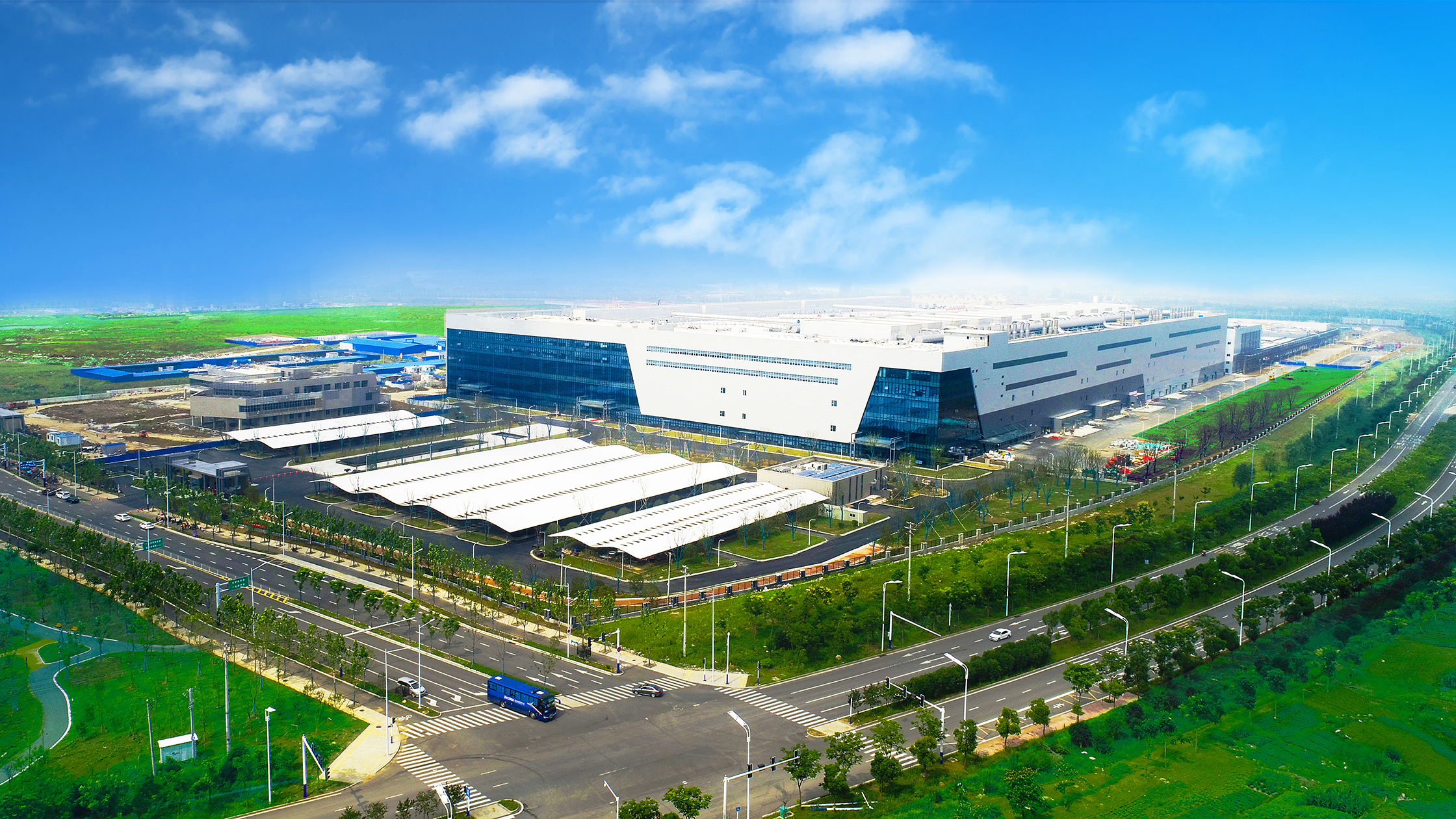

(Image credit: CXMT)

China's largest domestic memory maker ChangXin Memory Technologies (CXMT), is preparing for a major IPO in Shanghai, aiming to raise roughly $4.2 billion USD to expand production and fund next-generation DRAM development. On its face, it's a straightforward business story: a fast-growing chipmaker capitalizing on a strong market. Viewed through the lens of today's global RAM shortage, the move is more interesting and more complicated.

As reported by the South China Morning Post, news of the IPO hasn't come out of the blue; it isn't the first time we've heard about this, but this time the announcement is official, and CXMT's timing isn't accidental. The company nearly doubled its revenue year-over-year in 2025 and expects to swing back into profitability, largely thanks to a rebound in DRAM pricing. That rebound, in turn, is being driven by an unusually strong mix of demand from AI infrastructure, cloud providers, and device manufacturers, all competing for a finite supply of memory chips. In other words, CXMT is going public during one of the most memory-hungry periods the industry has ever seen.

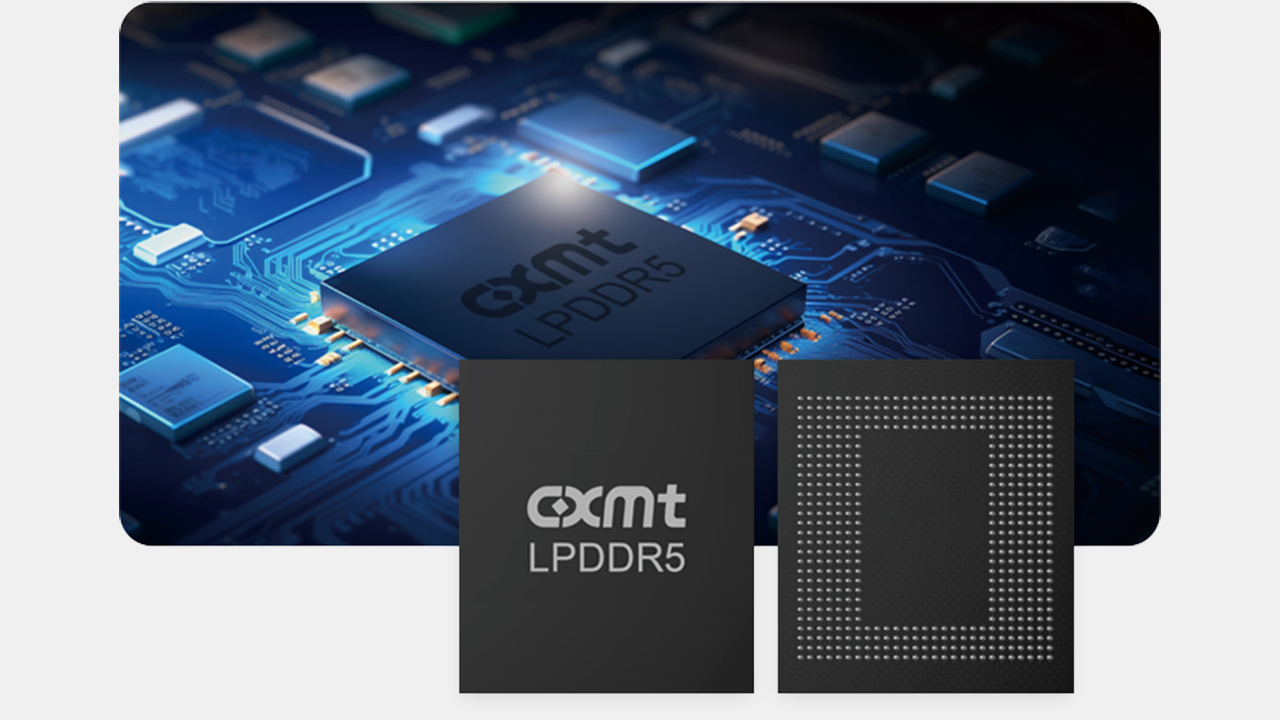

(Image credit: CXMT)

That means CXMT's expansion may help stabilize things in the medium term, but it's unlikely to provide immediate relief for PC builders or consumers wondering why DDR5 prices are still elevated. It's also worth noting what CXMT is not doing: the company isn't racing to flood the market with ultra-cheap consumer RAM. Like every other major memory manufacturer, it's prioritizing higher-margin products and long-term customers. That's just how the economics work now.

In fact, it's possible that CXMT's expansion could make things worse in the near term; after all, as companies like CXMT ramp up, they compete for the same fabrication equipment, materials, and engineering talent as Samsung, Micron, and SK hynix. That competition can actually tighten supply elsewhere, especially for legacy memory nodes that consumer hardware still relies on. The result is what we're already seeing: higher prices, longer lead times, and fewer options at the low end of the market.

Get Tom's Hardware's best news and in-depth reviews, straight to your inbox.