Coforge–Encora deal likely to be long-term positive: Analysts

Coforge's acquisition of Encora is seen as a transformative, high-stakes deal strengthening long-term capabilities but creating near-term pressure on earnings and stock. Analysts cite the acquisition's size, valuation, and complexity as reasons for potential short-term stock weakness, though many view the recent correction as a buying opportunity for long-term investors.

Analysts at brokerages said Coforge’s acquisition of Encora is a high-stakes, transformative deal that strengthens long-term capabilities but brings near-term pressure on earnings and the stock. Some analysts flag the size, valuation and complexity of the acquisition, along with earnings uncertainty and potential fund-raising, as reasons the stock may remain under pressure in the short run.

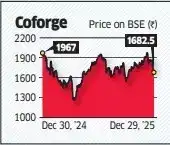

At the same time, most see the recent stock price correction as largely reflecting these risks. Coforge shares ended 0.6% higher at Rs 1,682 on Monday, giving up most of its early-day gains.

Agencies

Agencies

Morgan Stanley

- Near-term, stock to remain under pressure as investors digest the scale of the acquisition, earnings uncertainty and anticipation of a QIP

- Any material weakness from here could present an opportunity for long-term investors to accumulate the stock

Kotak Institutional Equities

- Encora is Coforge’s largest and perhaps most complex buyout; acquisition is pricey and stakes are high

- Sharp and immediate execution of synergies will be key to the buyout being EPS accretive in FY27 —a challenging task CLSA

- While slightly expensive, acquisition will help Coforge strengthen its capabilities and help in strong client additions

- Recent stock price correction is a strong opportunity to accumulate

Jefferies

- Acquisition is large, but Coforge’s strong track record of managing acquisitions is reassuring

- If executed well, the Encora deal could drive a re-rating of Coforge