Credit demand zooms as policy eases, outstanding bank credit crossed Rs 200 lakh cr for the first time on Dec 31, 2025

India's credit demand is surging. Lower taxes and supportive monetary policy are fueling investment. Outstanding bank credit has crossed a major milestone. This growth surpasses projections, indicating a strong economic rebound. Auto loans, small and mid-sized companies, and home loans are key drivers. Investment intentions are translating into spending, creating a positive environment.

Mumbai: Credit demand in India is getting a boost from the reduction in the goods and services tax (GST) and a more accommodating monetary policy, which have helped spur investment activity, data from the Centre for Monitoring Indian Economy (CMIE) shows.

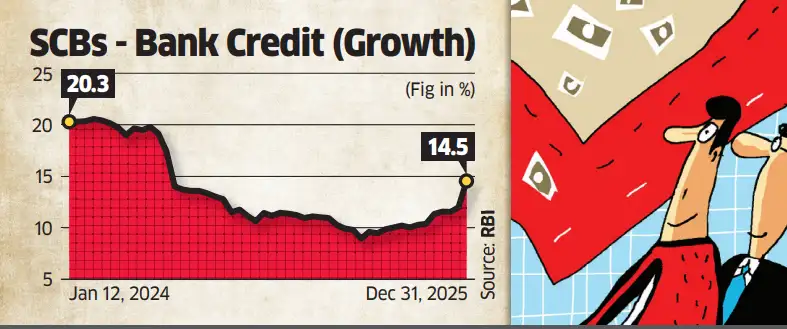

As of the end of December, credit demand saw a year-on-year growth of 14.5%, according to CMIE data.

Investment proposals in the first nine months of the financial year increased to ₹26.62 lakh crore, up from ₹23.62 lakh crore a year ago, data showed, supporting the pickup in credit growth. Outstanding bank credit at the end of December stood at ₹203.2 lakh crore, crossing the ₹200-lakh crore mark for the first time. Year-to-date (YTD) credit expanded by ₹20.78 lakh crore, compared with an increase of ₹13.18 lakh crore in the same period a year ago.

At 11.4%, the YTD credit growth surpassed the previous year's 8%, despite lingering uncertainty over trade deals, pointing to a rebound driven by rate cuts. The pace of credit expansion has already exceeded the 11% growth projected for FY26 by the Reserve Bank of India and professional forecasters in the Monetary Policy Report released in October.

This month's credit and deposit data was released after recent amendments to the Banking Regulations Act, 1949, that allow the RBI to publish credit and deposit numbers on the 15th and the last day of the month, instead of alternate Fridays-a move aimed at reducing interpretational ambiguity.

Outstanding aggregate deposits stood at ₹248.5 lakh crore, up 12.7% on a year-on-year (y-o-y) basis and 10.1% on a YTD basis. In the corresponding period a year ago, deposits rose by 9.8% y-o-y and 7.8% on a YTD basis.

"Credit growth is being driven largely by auto loans, which typically pick up at the end of the calendar year, along with demand from small and mid-sized companies, finance companies and the home loan segment," said Saurabh Bhalerao, associate director and head of BFSI research at Care Ratings. "That said, a base effect has also come into play. Last year's data was for December 27, 2024, the final reporting Friday of the month, which makes the 14.5% growth appear particularly strong," he said.

A bank analyst said, "In any case, the growth looks high partly because these are month-end numbers, and one should factor in an element of window dressing that happens at the end of every quarter. Also, due to this base effect, the 14.5% credit growth may not be sustainable."

A credit growth of 14.5% was last reported on July 12, 2024, RBI data showed.

That said, demand could remain resilient if higher investment intentions translate into actual spending.