Investment planning: Stocks, FDs, gold, crypto & more — your smart money guide to 2026

Financial assets in 2026 will be shaped by central bank actions and trade deal prospects, amidst expected volatility. Investors should approach stocks with caution, while gold and silver are poised for continued gains. Mutual funds are set to cross $1tn AUM, and bond yields may rise.

The focus in 2026 will be on sustaining the growth momentum despite challenges like tariffs and foreign fund selloff. Financial assets are expected to be driven by central bank actions and trade deal prospects in the first half of 2026 amid heightened volatility. So, what should your strategy be in the New Year? Partha Sinha & Mayur Shetty explain...

Stocks lose sheen , FD rates may not rise, is gold still an option?

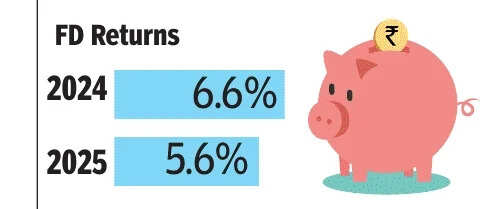

Losing interest in FDs?There’s not much leeway for banks to cut interest rates from the current levels. While credit offtake is showing good traction, deposit mobilisations are in the slow lane. In such a situation, it’s unlikely banks will cut FD rates aggressively. This could be good news for those who prefer the relative safety of FDs and are due to rollover their funds

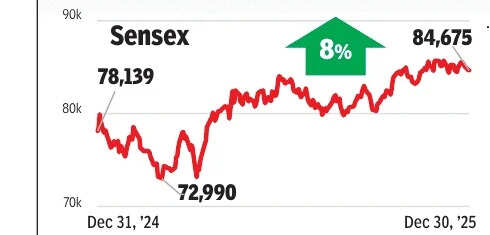

Stock up with caution in new yearLeading indices could remain fence-sitters in early months of the year. Signs of a turnaround in corporate numbers and strong domestic flows are expected to push benchmark indices higher. However, limited progress on India-US trade deal, geopolitical uncertainties, foreign fund selling and the weak rupee would weigh on equities

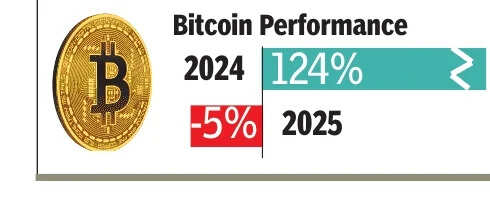

Crypto conundrumIf 2025 was a watershed year for crypto, with most major economies tilting heavily in favour of these digital assets, 2026 could see gains, building off the developments of the previous year. Institutional demand for cryptocurrencies could rise

Gold & silver: Going up, up, upAfter two years of record-breaking gains, the two precious metals are unlikely to see any meaningful corrections.

Geopolitical tensions, an uncertain global market, investment demand and especially for silver, rising industrial demand amid uncertain supplies, are seen combining to keep prices of these precious metals at elevated levels.

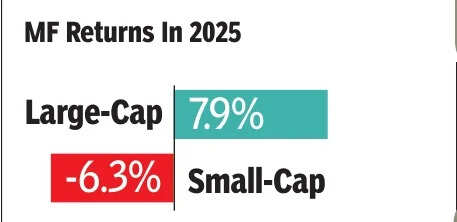

Mutual funds: Your long-term betIf we extrapolate the 20% CAGR for the industry’s AUM of the last decade into next year, 2026 should turn out to be the landmark year when the fund industry would cross the $1tn AUM mark.

Also expect the growth of passive funds to continue to surpass the same for actively managed ones.