ITC slides to three-year low as tobacco excise hike prompts brokerage downgrades

ITC shares plummeted to a three-year low following a government excise duty hike on tobacco products. Brokerages downgraded the stock, citing fears of dampened cigarette demand and significant impact on profitability. Investors are advised to wait for clarity on price hikes and volume trends before considering buying.

Synopsis

ITC shares plummeted to a three-year low following a government excise duty hike on tobacco products. Brokerages downgraded the stock, citing fears of dampened cigarette demand and significant impact on profitability. Investors are advised to wait for clarity on price hikes and volume trends before considering buying.

Agencies

Agencies

Srivastava said further slides cannot be ruled out and may present buying opportunities, but investors should avoid the stock for now, given the core business impact.

Mumbai: Shares of cigarette-to-consumer goods conglomerate ITC closed at a three-year low on Friday, extending losses to the second straight session after most brokerages downgraded it following the government's announcement of an additional excise duty on tobacco products effective February 1.

The stock fell 3.8% to ₹350.1 on Friday, after plunging close to 10% on Thursday.

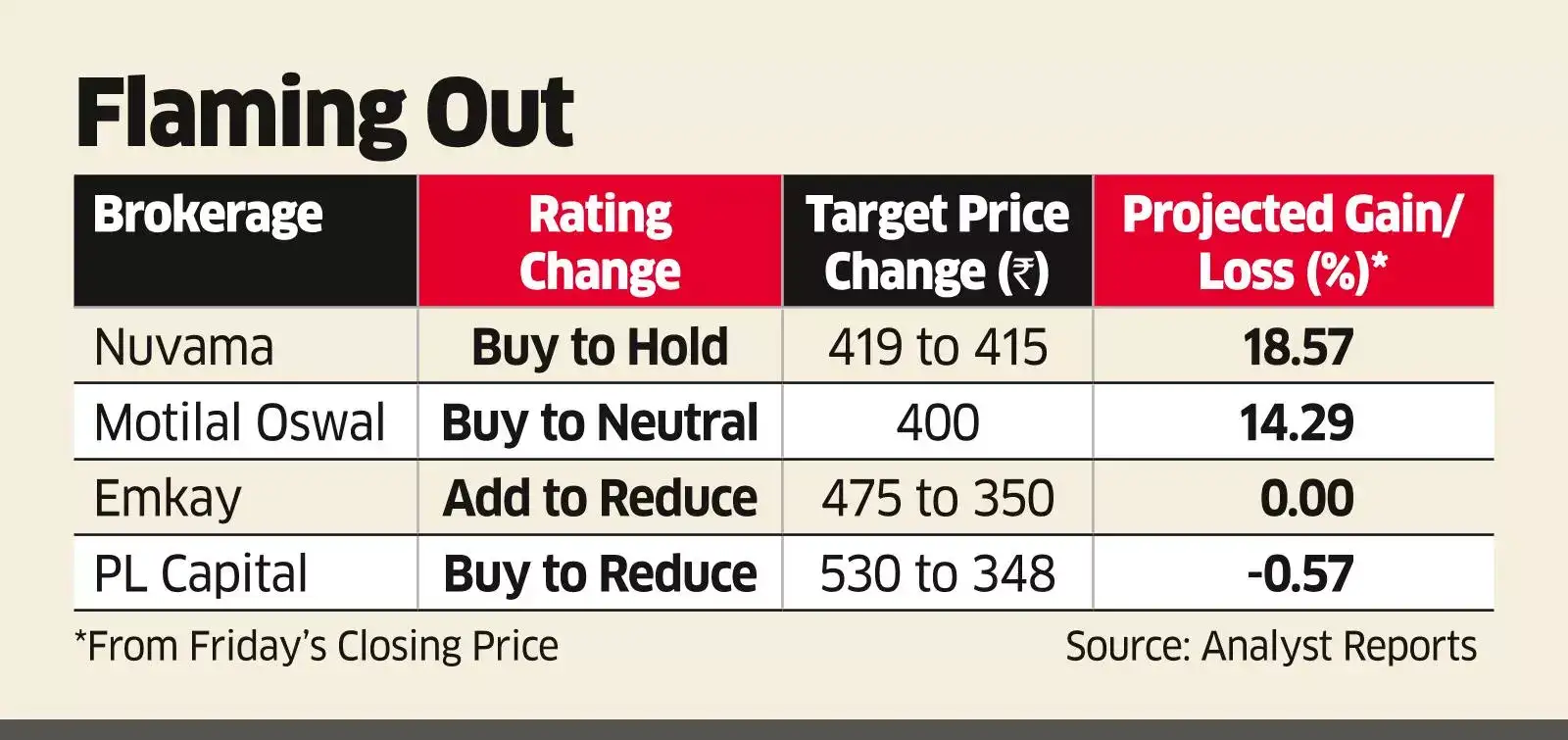

Most brokerages downgraded the stock from bullish calls to cautious or bearish ratings after the excise duty hike, as the move is seen as increasing cigarette prices, which is feared to dampen demand.

Nuvama, which downgraded ITC from 'buy' to 'hold', said, "While we expected a sharp tax hike on cigarettes, the magnitude seems higher than anticipated, likely prompting consensus downgrades to ITC's cigarette volume and EBITDA (earnings before interest, tax, depreciation, and amortisation) estimates as well as multiples."

The stock's Friday closing is the lowest since February 2023, reflecting concerns over the impact of a squeeze on the company's cigarette unit on overall profitability. ITC's cigarette business, its most profitable segment, contributes over 40% to the overall revenue.

"The drastic announcement of a GST hike to 40% and excise duty based on cigarette length could lead to ITC hiking prices by 20-30%," said Sonam Srivastava, founder and CEO of Wright Research. "Since 40% of the company's revenues come from cigarettes and the segment contributes 80% of profits, the impact is expected to be significant."

Heavy volumes suggested institutional selling, keeping near-term sentiment cautious.

Agencies

Agencies

ALL BETS OFF FOR NOW: Analysts say further downsides cannot be ruled out, and advise investors to wait for clarity on business impact to emerge by next month before buying the stock