Local banks healthiest in decades, small lenders gain market share

Indian banks saw a slight decrease in their market share by March 2025. Foreign banks and smaller lenders gained ground. Bad loans reached a multi-decade low. However, fraud amounts rose significantly due to reclassification. State-run and private banks' shares edged down. Loan growth was strong for state-run banks. Net profits increased, but at a slower pace.

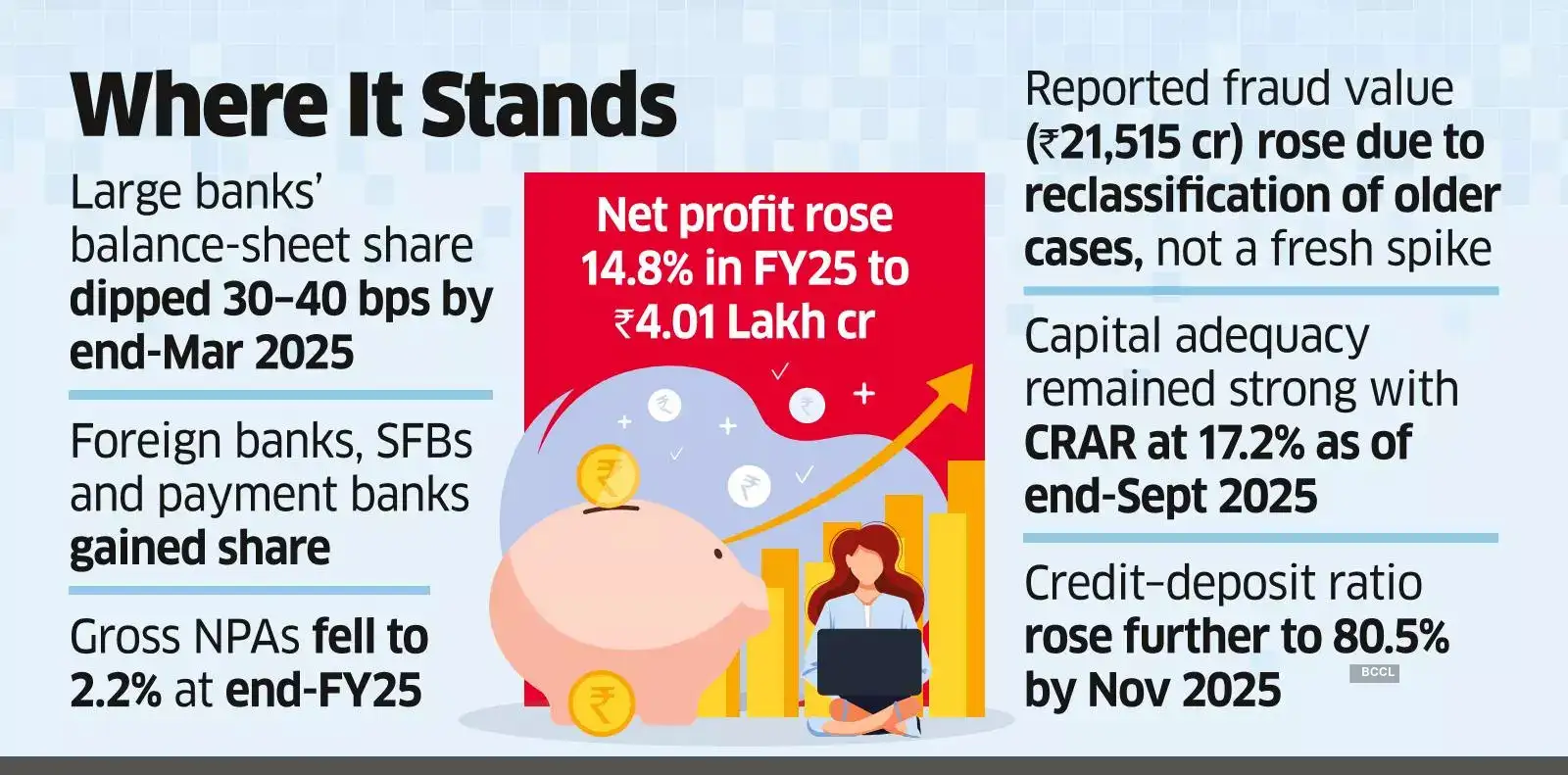

Mumbai: Indian banks saw a marginal moderation of about 30-40 basis points in their balance-sheet share at the end of March 2025, while foreign banks, small finance banks and payment banks gained market share, showed the latest regulatory report titled "The Trends and Progress of Banking in India."

Asset quality improved sharply, with bad loans declining to multi-decadal lows of 2.1% as of end-September 2025. However, the value of frauds rose significantly to ₹21,515 crore during April-September 2025 due to reclassification of some accounts.

The share of state-run banks in the consolidated balance sheet of commercial banks declined to 54.9% at end-March 2025 from 55.2% a year earlier. The share of private sector banks also edged down to 37.1% from 37.5% over the same period. In contrast, foreign banks, small finance banks and payment banks increased their share during 2024-25.

Loan growth at state-run banks during 2024-25 translated into their share of total advances rising to 56.2% at end-March 2025 from 55.5% at end-March 2024, even as their share in total deposits declined to 58.8% from 59.3%. In Q2 FY26, SBI's total business crossed ₹100 lakh crore, with deposits at ₹55.9 lakh crore and advances at ₹44.2 lakh crore.

Net profits of scheduled commercial banks increased during 2024-25, though at a slower pace than in the previous year, partly reflecting moderation in net interest income growth. Net profit rose 14.8% to ₹4.01 lakh crore at end-March 2025, compared with a 32.8% increase in the prior year.

The credit-deposit ratio of banks rose to 79.2% at end-March 2025 from 78.8% a year earlier and further increased to 80.5% at end-November 2025. All bank groups remained well capitalised, with the capital to risk-weighted assets ratio (CRAR) at 17.2% as of end-September 2025.

The improvement in asset quality observed since 2018-19 continued through 2024-25. The gross non-performing asset (GNPA) ratio of scheduled commercial banks declined to a multi-decadal low of 2.2% at end-March 2025 from 2.7% a year earlier and further eased to 2.1% at end-September 2025. The slippage ratio declined for the fifth consecutive year to 1.4% at end-March 2025 and fell further to 1.3% by end-September 2025.

During 2024-25, based on the date of reporting by banks, the total number of frauds declined, even as the amount involved increased. This rise was largely due to the re-examination and fresh reporting of 122 fraud cases amounting to ₹18,336 crore to ensure compliance with a Supreme Court judgement. Between April and September 2025, the total amount involved in frauds stood at ₹21,515 crore across 5,092 cases, compared with ₹16,569 crore involving 18,386 cases in the same period of the previous year.