Looking sharp! Trent plans high store density in mature markets

Trent’s strategy is similar to some of the world’s largest retailers, including Spain’s Inditex, owner of Zara, and British department store chain Primark, which has long prioritised dense store networks in high-footfall catchments, using scale for more bargaining power with vendors and real estate developers.

Mumbai: Tata-owned Trent is sharpening its focus on store portfolio growth and optimisation, chief executive P Venkatesalu said, as the country's largest fashion retailer by market value sees a gradual recovery in consumer sentiment.

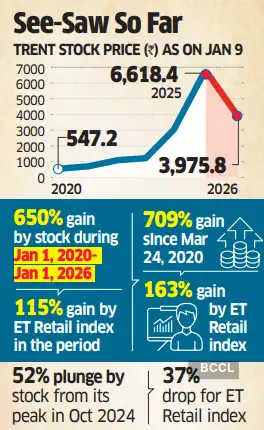

The company that pursued an aggressive store expansion strategy in recent years plans to keep adding new outlets in areas where it already has a presence in big cities, as well as move to smaller markets, in the current phase. Amid its quick spread, Trent's stock has seen peaks and troughs. While shares gained nearly seven-and-a-half times since the pandemic, they are down more than a third this past year. The scrip ended near its 52-week low, at ₹3,975.8, on the BSE on Friday.

"Consumer sentiment today is neither euphoric nor despondent. It is gradually improving. Outlook over the medium term is positive," Venkatesalu told ET. "The agenda is to pursue growing reach and share of revenues as we selectively increase density of presence across key markets with an improving customer proposition. We expect newer catchments to mature over time, in terms of adoption of fashion trends and density of consumption."

High-Footfall Catchments

Trent has undertaken one of the fastest expansion drives by any retailer in the country, with its value retail format, Zudio, opening more than 700 stores in the past four years. “We will continue to grow our presence in both existing and new geographies. The smaller markets will mature over time,” Venkatesalu said.

Trent’s strategy is similar to some of the world’s largest retailers, including Spain’s Inditex, owner of Zara, and British department store chain Primark, which has long prioritised dense store networks in high-footfall catchments, using scale for more bargaining power with vendors and real estate developers. “We have a mix of home-grown and expatriate talent, but culturally, we remain focused on building a nimble, agile organisation—one that can adapt quickly, listen closely to grassroots signals and take calculated risks. This ability to evolve is critical to winning with the consumer,” the Trent chief said.

According to Venkatesalu, scale brings its own complexities and advantages as the organisation grows. Value retailing where Zudio operates has seen a flurry of new competition — from Reliance and Shoppers Stop to Aditya Birla Fashion & Retail — over the past few quarters.