Negative Breakout: These 14 stocks cross below their 200 DMAs

In the Nifty 500 segment, the closing prices of 14 stocks fell below their 200-day DMA (Daily Moving Average) on December 29, according to StockEdge’s technical scan data. Trading below the 200 DMA is considered a negative signal because it indicates that the stock's price is below its long-term trend line. The 200 DMA is used as a key indicator by traders for determining the overall trend in a particular stock. Take a look:

Written by

, ETMarkets.com|

Dec 30, 2025, 07:45:52 AM IST

1/14

Downside Ahead

In the Nifty 500 segment, the closing prices of 14 stocks fell below their 200-day DMA (Daily Moving Average) on December 29, according to StockEdge’s technical scan data. Trading below the 200 DMA is considered a negative signal because it indicates that the stock's price is below its long-term trend line. The 200 DMA is used as a key indicator by traders for determining the overall trend in a particular stock. Take a look:

ETMarkets.com

2/14

Jupiter Wagons

200 DMA: Rs 343.08| LTP: Rs 337.7

ETMarkets.com

3/14

Capri Global Capital

200 DMA: Rs 178.66| LTP: Rs 176.18

ETMarkets.com

4/14

Pfizer

200 DMA: Rs 5026.73| LTP: Rs 4959.2

ETMarkets.com

5/14

Jubilant Pharmova

200 DMA: Rs 1066.14| LTP: Rs 1053

ETMarkets.com

6/14

DOMS Industries

200 DMA: Rs 2561.66| LTP: Rs 2532.1

ETMarkets.com

7/14

CESC

200 DMA: Rs 166.12| LTP: Rs 164.67

ETMarkets.com

8/14

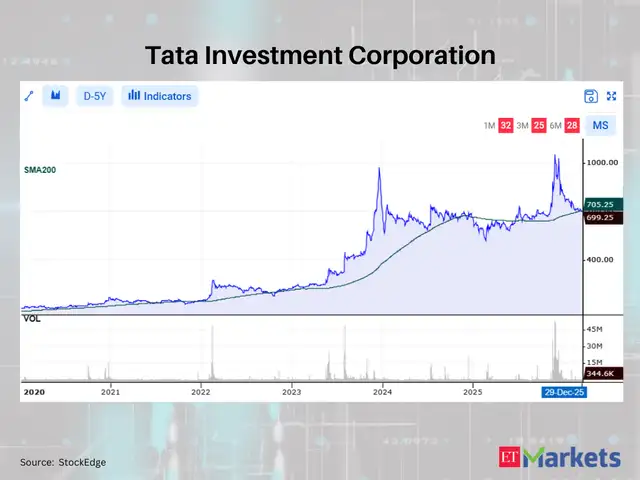

Tata Investment Corporation

200 DMA: Rs 705.25| LTP: Rs 699.25

ETMarkets.com