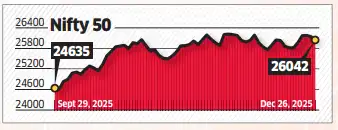

Nifty faces 26,200 hurdle; indicators flag uncertainty

Nifty 50 is consolidating near all-time highs, facing resistance at 26,200, indicating near-term indecision. Analysts suggest range-bound trade with sector-specific opportunities, while Bank Nifty shows signs of potential profit-booking. Experts recommend specific stock bets like Lupin and Varun Beverages for potential gains.

Nifty 50 is entering a consolidation phase with the index struggling to sustain a move above 26,200. Technical indicators point to near-term indecision and range-bound trade, even as low volatility and selective sectoral strength keep the broader bias supportive.

**ROHAN SHAH

**TECHNICAL ANALYST, ASIT C. MEHTA INVESTMENT INTERMEDIATES

Where is Nifty headed?

Nifty is hovering within a well-defined range of 26,300– 25,700 near its all-time highs. The index is expected to undergo further price- and time-wise consolidation before registering a decisive breakout. In the interim, sector-specific opportunities are expected to play out.

Trading Strategies: Bank Nifty is facing resistance near the upper end of its multi-month rising channel, with momentum indicators indicating overbought conditions. On lower time-frame charts, a potential head-and-shoulders pattern is developing. A decisive break below the neckline could lead to profit-booking. Traders may short Bank Nifty January futures below 59,000 for targets of 58,200–57,800, with a stop-loss above 59,600.

**TOP STOCK BETS:

**Lupin: Buy for a target of Rs 2,300, with stop-loss at Rs 1,975. The stock is trading firmly above the 200-EMA on weekly timeframe, confirming long term strength. On daily chart, it has registered a decisive breakout from a VCP setup, indicating a bullish bias.

Varun Beverages: Buy for a target of Rs 540, with stop-loss at Rs 450. Stock is showing signs of a potential trend resumption after a prolonged corrective phase. It is nearing a breakout from an ongoing symmetrical triangle pattern. MACD line is gradually moving higher and converging with its signal line, reinforcing the bullish bias.

**NILESH JAIN

**HEAD OF DERIVATIVES AND TECHNICAL RESEARCH, CENTRUM BROKING

Where is Nifty headed?

Nifty began the week with a gap-up opening but failed to sustain levels above the immediate resistance at 26,200 on a closing basis. On the downside, immediate support is at 26,000, aligned with the short-term 21-DMA, while the next major support at 50-DMA is seen around 25,910. In the coming week, Nifty is expected to gradually move higher and retest recent highs near the 26,200 level. Meanwhile, India VIX remains near its historical lows of around 9.10, supporting the prevailing bullish sentiment.

Trading Strategies: Ahead of the monthly F&O expiry in the coming week, Nifty may witness short covering. Accordingly, a Bull Call Spread in the December series is recommended. The strategy involves buying one lot of 26,000 Calls at a premium of Rs 97 and simultaneously selling one lot of 26,100 Calls at a premium of Rs 47, resulting in a net debit of Rs 50. A stop-loss can be placed at Rs 20, while the spread offers upside targets of Rs 75 and Rs 90. The break-even level for the strategy is placed at 26,050.

Agencies

Agencies