Nifty in a bear hug, needs to break above 26,100 levels: Analysts

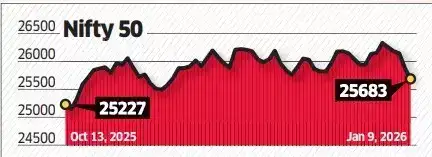

Indian equity markets face a bearish outlook as the Nifty breaks key supports. Analysts predict further declines, with the Nifty potentially testing the 25,300 to 25,350 levels. Sentiment is unlikely to improve without a strong rebound above 26,100. Investors are advised to adopt a sell-on-rise strategy.

The Nifty enters the new week on a weak footing after breaking key trend supports and short term moving averages, signalling a bearish bias. Persistent selling on intraday recoveries and rise in volatility suggest downside risks toward the 25,300–25,350 zone, while sentiment is unlikely to stabilise unless the index decisively moves back above the 25,900–26,100 resistance band.

SOMIL MEHTA

HEAD OF ALTERNATE RESEARCH, MIRAE ASSET SHAREKHAN

Where is Nifty headed?

The Nifty has broken below its ascending trendline and closed under the key 20-day moving average (DMA) of 26,062 and the 40-DMA at 25,970, confirming short-term weakness. Momentum indicators have flashed a negative crossover. The index could drift toward 25,300, with a “sell on rise” strategy advisable until a decisive break above the 26,100 resistance. A put-call ratio of 0.51 signals bearish sentiment, while volatility is likely to persist. Trading strategies Nifty (Positional): Sell on a bounce toward 26,000 for targets of 25,800 and 25,300, with a stop loss at 26,200. Avoid fresh long positions until a DEMA crossover reversal is seen.

TOP STOCKS

LIC: Sell at Rs 830, stop loss at Rs 860, target Rs 750. The stock has broken a bearish flag pattern on the daily chart and is trading below its 20-day moving average. Momentum indicators have given a negative crossover, and the trend is expected to continue downward.

CAMS: Sell at Rs 727, stop loss at Rs 760, target Rs 650. The stock has broken a bearish triangle pattern on the daily chart and is trading below its 20-day moving average. Momentum indicators have turned negative, suggesting further downside.

RUPAK DE

SENIOR TECHNICAL ANALYST, LKP SECURITIES

Where is Nifty headed?

Technically, the index has broken below its rising trendline, indicating rising bearish sentiment across the market. It has also slipped below its 50-day EMA (25,902.7) on the daily timeframe for the first time in over three months, signalling a bearish shift in trend. India VIX has spiked sharply and moved above its 50-day EMA (10.6), reflecting heightened investor anxiety. Trading strategies Bank Nifty has formed a dark cloud cover pattern on the weekly chart, a bearish reversal signal. A selling opportunity may emerge once Bank Nifty falls below last week’s low of 59,154. Traders can sell Bank Nifty below 59,150 for a target of 58,800, with a stop loss above 59,300.

Agencies

Agencies