Nvidia says H200 demand in China is 'very high' as export licenses near completion — a month after the green light, Huang has high hopes for China buy-in despite political sensitivity

Nvidia says demand in China for its H200 data center GPU is “very high,” as it works through the final stages of U.S. export licensing, according to comments from Jensen Huang at CES 2026.

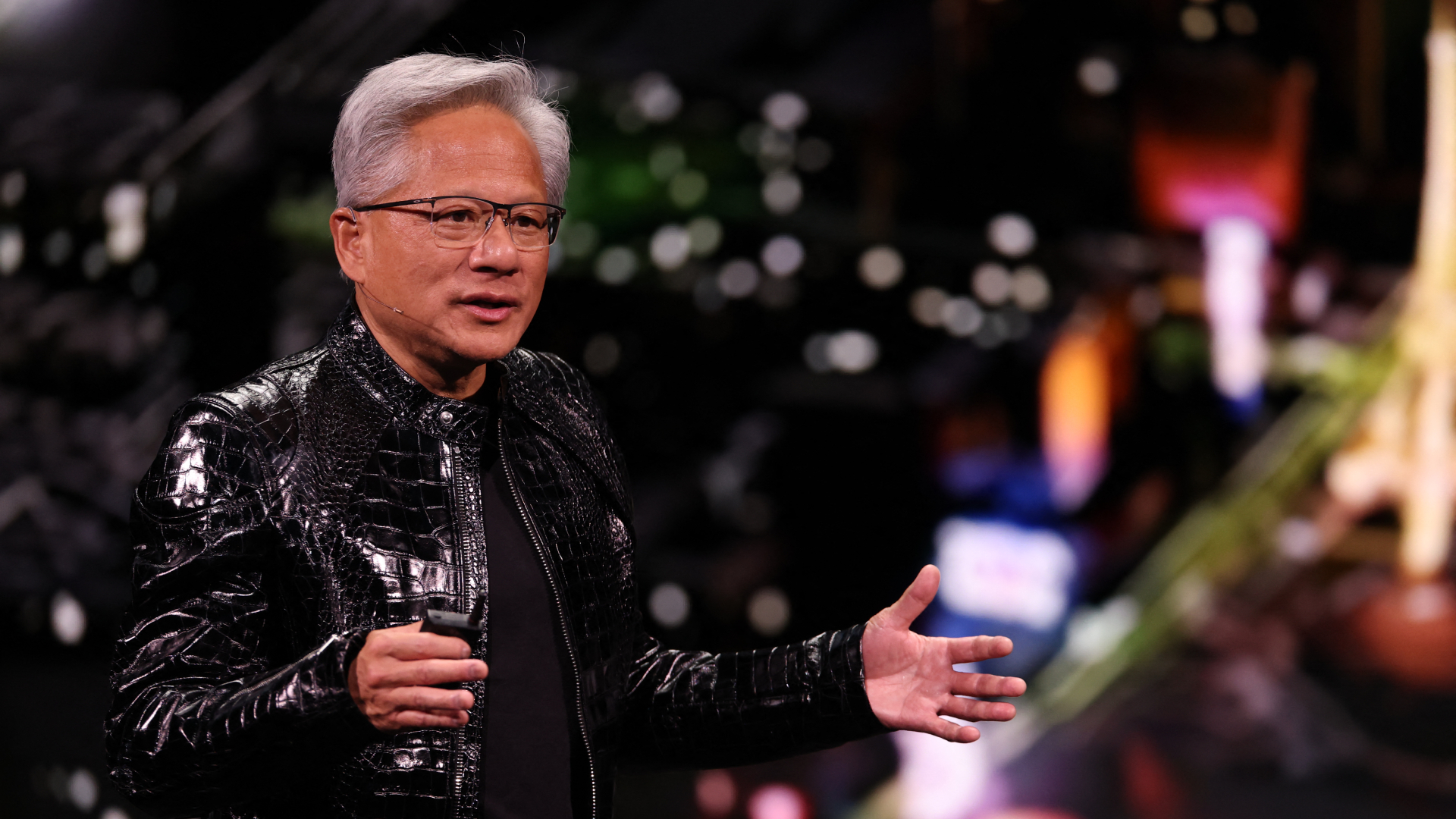

(Image credit: Getty Images / Patrick T. Fallon)

Nvidia says demand in China for its H200 data center GPU is "very high," but the company is deliberately avoiding timelines or announcements as it works through the final stages of U.S. export licensing, according to comments from CEO Jensen Huang at CES 2026. The remarks come nearly a month after the Trump administration said it would approve licenses allowing Nvidia to resume limited shipments of advanced AI accelerators to Chinese customers, subject to a 25% tax and additional oversight.

Speaking during a CES 2026 Q&A session with journalists, including Tom's Hardware in Las Vegas, Huang confirmed that Nvidia has already restarted its supply chain for H200 and is preparing to ship once the remaining regulatory details are resolved. He declined to offer dates or volume targets, instead emphasizing that actual purchase orders will determine how much hardware ultimately moves into China.

"The customer demand is high. It’s quite high. It’s very high," Huang said. He added that Nvidia has "fired up" its supply chain and that H200 systems are already flowing through production. The gating factor, he said, is the completion of licensing with the U.S. government, after which Nvidia expects orders to speak for themselves.

The restrained tone is notable given the political sensitivity around advanced AI hardware exports. Under the revised policy announced in December, Nvidia can sell H200 GPUs into China, but only under a licensing regime that includes a 25% charge and government review of shipments. It’s understood that Nvidia aims to begin shipments before Lunar New Year in mid-February, potentially using existing inventory to fulfil early orders while longer-term production ramps up. Those shipments, however, remain contingent on formal approvals.

Huang also made clear that Nvidia does not plan to trumpet individual deals or frame the restart of China sales as a major corporate milestone. “We’re not expecting any press releases or any large declarations,” he said, adding that the company expects to learn about market uptake through normal commercial channels.

Technically, the H200 remains a highly attractive option for large-scale AI workloads. Based on Nvidia’s Hopper architecture, it pairs the H100 GPU with 141GB of HBM3e memory and significantly higher memory bandwidth, making it particularly well-suited for training and inference of large language models. That capability gap is one reason Chinese customers have and higher costs.