PAN-Aadhaar link status: How to check it & what happens if you miss Dec 31 deadline?

PAN-Aadhaar linking: The Income Tax Department allows PAN–Aadhaar linking through multiple online options and urges taxpayers to confirm their linking status to keep their PAN active. Failure to complete the process before the deadline could render PAN inoperative from January 1, 2026.

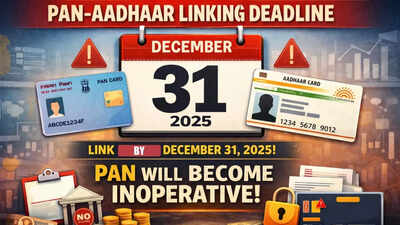

Individuals who fail to complete the process may find their PAN rendered “inoperative” from January 1, 2026. (AI image)

PAN-Aadhaar link status update: December 31, 2025 is the deadline for linking your PAN card with your Aadhaar card - an important step if you don't want your PAN card to become inoperative.

The Income Tax Department has again appealed to PAN holders to complete the mandatory linking of PAN with Aadhaar.

Taxpayers who miss this December 31, 2025 deadline face the risk of their PAN being rendered inoperative. With the cutoff date for PAN Aadhaar linking drawing closer, individuals who fail to complete the process may find their PAN rendered “inoperative” from January 1, 2026, according to an ET report.

Such a situation can create hurdles in filing income tax returns, receiving refunds and carrying out routine financial transactions.

PAN-Aadhaar Deadline Nears: How To Link Before December 31 Or Risk Inoperative PAN From Next Year

The Income Tax Department has warned that an inactive PAN cannot be used for key financial transactions or tax related purposes, underscoring the need to finish the process before the year ends.

PAN-Aadhaar Linking: How To Link Your PAN With Aadhaar Card

Taxpayers can complete the PAN Aadhaar linking by following these steps:

- Log in to the income tax e-filing portal (https://www.incometax.gov.in/iec/foportal/)

- Navigate to the profile section and select the option to link your PAN with Aadhaar

- Enter your PAN and Aadhaar details, then choose the option to proceed with payment through e-pay tax

- Select the applicable assessment year and choose “Other Receipts” as the payment category

- Verify the pre-filled payable amount and click on continue

- Generate the challan and make the payment through your bank’s portal

- Once payment is successful, return to the e-filing portal to finalise the linking process

- Enter your PAN, Aadhaar number and name exactly as recorded in Aadhaar, then click on “Validate”

- An OTP will be sent to your mobile number registered with Aadhaar; enter the OTP to proceed

- Submit the request to finish the linking process

Once you submit the request to link PAN with Aadhaar and the payment, if applicable, is reflected, the verification generally moves quickly.

The Income Tax Department forwards the details to UIDAI for validation. You can recheck the linkage status after a day or two to confirm that the process has been completed successfully, the ET report said.