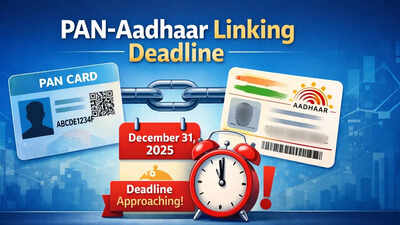

PAN-Aadhaar linking: Step-by-step guide to link your PAN with Aadhaar before Dec 31

PAN-Aadhaar linking deadline nears: Link your PAN with Aadhaar by December 31, 2025, or face consequences. Unlinked PANs become inoperative from January 1, 2026, impacting tax refunds and leading to higher TDS.

The Central Board of Direct Taxes has cautioned that non-compliance will have financial consequences. (AI image)

PAN-Aadhaar linking deadline nears: The final date to complete your PAN–Aadhaar card linking is December 31, 2025. Beginning January 1, 2026, the Income Tax Department will declare all PAN cards that remain unlinked with Aadhaar card as inoperative.As per Notification No. 26/2025, issued on April 3, 2025, individuals who were allotted a PAN using an Aadhaar Enrolment ID before October 1, 2024 are required to complete the linkage using their permanent Aadhaar card number by the end of 2025. PAN cards that are not linked by the deadline will be marked inactive or inoperative and cannot be used for tax-related or major financial transactions, according to an ET report.

PAN-Aadhaar Deadline Nears: How To Link Before December 31 Or Risk Inoperative PAN From Next Year

The Central Board of Direct Taxes has cautioned that non-compliance will have financial consequences, including suspension of income tax refunds and the application of higher tax deduction at source rates from January 1, 2026. To complete the linkage, taxpayers must first ensure that they have a valid PAN, an Aadhaar number, and a registered mobile phone to receive one-time passwords. A fee of Rs 1,000 is applicable in cases where the PAN was issued before July 1, 2017 and has not been linked earlier, the report said.

How to link PAN with Aadhaar card: Step-by-step guide

- To begin with, you will have to pay a mandatory fee through the Income Tax Department’s e-Filing portal.

- Visit the portal homepage (https://www.incometax.gov.in/iec/foportal/), select the Link Aadhaar option under Quick Links. Now enter your PAN card and Aadhaar card details.

- After choosing to pay through e-Pay Tax, you are required to re-enter your PAN, verify your mobile number through an OTP, select the Income Tax option, and proceed to payment.

- The assessment year must be selected and the payment category should be marked as Other Receipts (500). The Rs 1,000 amount is auto-filled and can be paid using net banking, debit card, or UPI. The payment may take four to five working days to reflect in the system.

- Once the payment is confirmed (which can take a few days), taxpayers can make the linking request.

- Go to the Link Aadhaar section, enter your PAN and Aadhaar details, and validate the information.

- A confirmation message stating "Your payment details are verified." should appear, after which users must enter their name as per Aadhaar and their mobile number.