Rising incomes, rural recovery to power corporate India’s 2026 growth

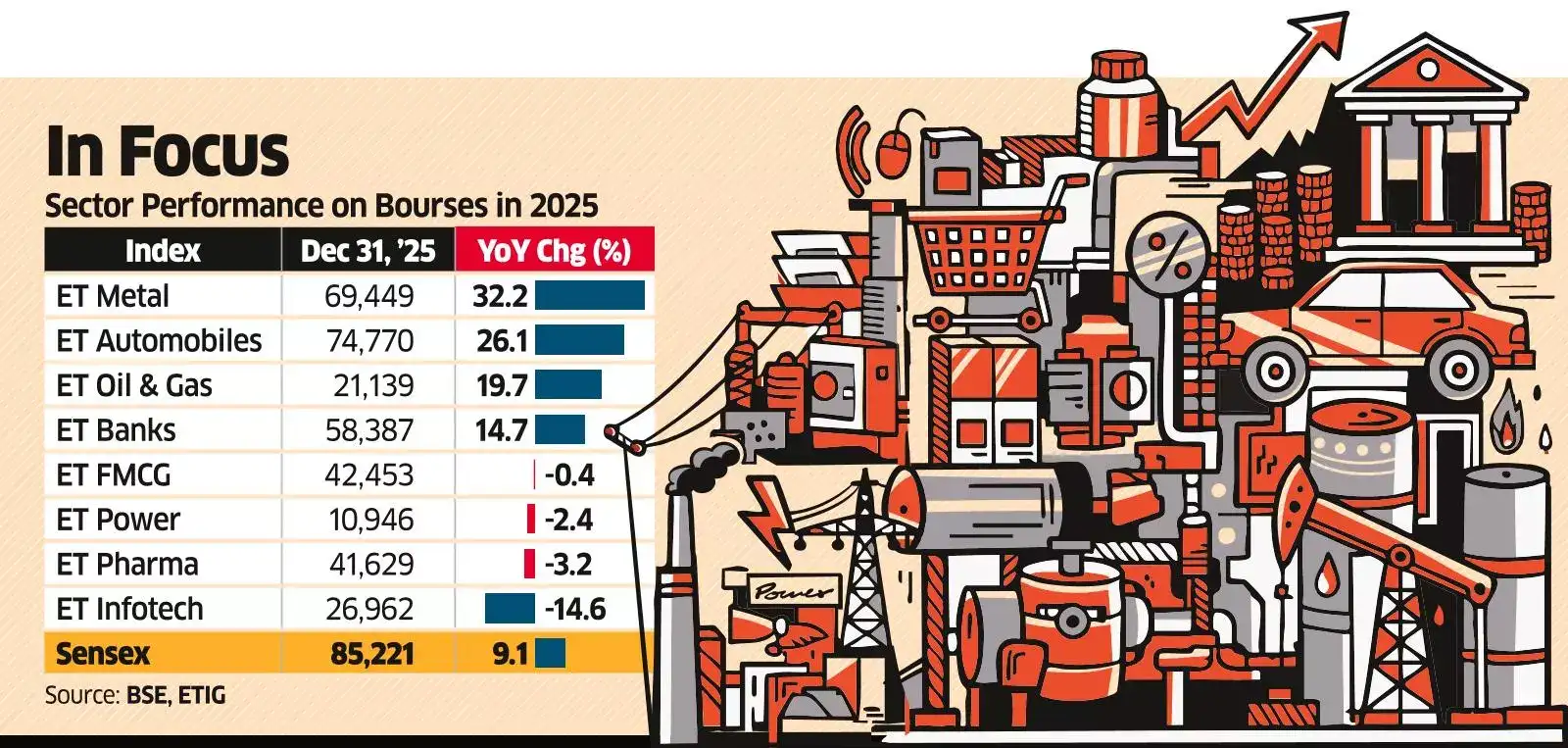

Corporate India anticipates improved performance in 2026, driven by rising disposable incomes, a stronger rural economy, and infrastructure spending, partially offsetting rupee depreciation. Key sectors like automobiles, banking, FMCG, IT, metals, oil & gas, power, and pharmaceuticals are poised for growth, with AI and premiumization emerging as dominant themes.

Mumbai: The performance of corporate India is expected to improve in 2026 compared with the previous year given the rising disposable income, improving rural economy, sustained capital expenditure in the infrastructure sector and softening crude oil prices, which may partially offset the impact of depreciating rupee on fuel costs. ETIG offers a snapshot of what to expect from some of the major sectors in the new year.

The demand momentum is expected to continue for automobile companies in the early part of 2026, driven by affordability due to GST rate cut, festive spill over, and marriage season. In the later part of the year, it is likely to normalise with premiumisation, electrification, and cost management emerging as dominant themes. For passenger vehicles (PV), entry-level cars and value SUVs are likely to remain key drivers, supported by rural recovery and financing availability. Companies are likely to raise prices in the new year to compensate for the costs associated with the Corporate Average Fuel Efficiency (CAFE) norms pertaining to fuel efficiency and emissions. The first half of 2026 is expected to show high single-digit growth, aided by new launches and export traction. This may, however, reduce to low single digit in the second half as the GST boost fades and base effect kicks in. Two-wheelers are likely to deliver steady growth driven by scooters and premium motorcycles. Electric vehicles (EV) adoption is facing near-term headwinds as GST revision has widened the affordability gap against conventional fuel (ICE) models. Maruti Suzuki India, Mahindra & Mahindra and TVS Motor Company look well positioned.

Banking and finance

After a year of muted growth, the banking sector is poised for a rebound in credit and an improvement in net interest margins (NIMs). At the end of November, advances grew 11.5% year-on-year while deposits rose 10.2%, according to the RBI data. After peaking at 20% in FY24, credit growth slowed to 11% in FY25 as banks turned cautious amid rising stress in unsecured loans. In 2026, credit growth is likely to remain at 11-12%, driven by micro, small and medium enterprises (MSME) lending and gradual improvement in industrial and retail segments, according to Kaitav Shah, lead BFSI analyst at Anand Rathi Institutional Equities. The RBI's 125-basis-point repo rate cut through four reductions in 2025 is expected to keep lending rates low, supporting credit growth in 2026. Policy measures such as lower risk weights, relaxed large exposure norms, and higher limits on loans against shares will further aid recovery. While one more rate cut is expected in early 2026, consensus suggests the easing cycle is over. Deposit repricing should conclude by mid-2026, helping NIMs stabilise in the first half of FY26 and expand later. Asset quality is likely to remain benign, though MSME and unsecured segments may see some stress. Lenders such as SBI, HDFC Bank, ICICI Bank, Axis Bank, Federal Bank, and AU Small Finance Bank are expected to benefit from the credit revival and margin expansion.

Agencies

Agencies