Stock Market Outlook 2026: Why blue-chip stocks are preferred equity bet for investors?

Money managers favor blue-chip stocks for 2026, anticipating foreign investor interest and better valuation comfort. While Nifty gained 10.5% in 2025, mid and small caps lagged. Experts predict Nifty and Sensex gains of 8-14% in 2026, with large caps expected to lead initially.

Synopsis

Money managers favor blue-chip stocks for 2026, anticipating foreign investor interest and better valuation comfort. While Nifty gained 10.5% in 2025, mid and small caps lagged. Experts predict Nifty and Sensex gains of 8-14% in 2026, with large caps expected to lead initially.

Listen to this article in summarized format

ETMarkets.com

ETMarkets.com

Fund managers prefer large-and mid-caps in spite of a drop in small-cap stock prices

Mumbai: Blue-chip stocks are the preferred equity bets in 2026 compared to their smaller peers, as they are better positioned to benefit from foreign investors potentially turning bullish on India again, according to money managers.

"We like large caps in the new year over mid and small caps because they offer valuation comfort and earnings growth of around 12-14%," said Mahesh Patil, CIO, Aditya Birla Sun Life AMC. "When the foreign investors make a comeback in India, they are expected to deploy funds in large caps as they are oversold in this segment."

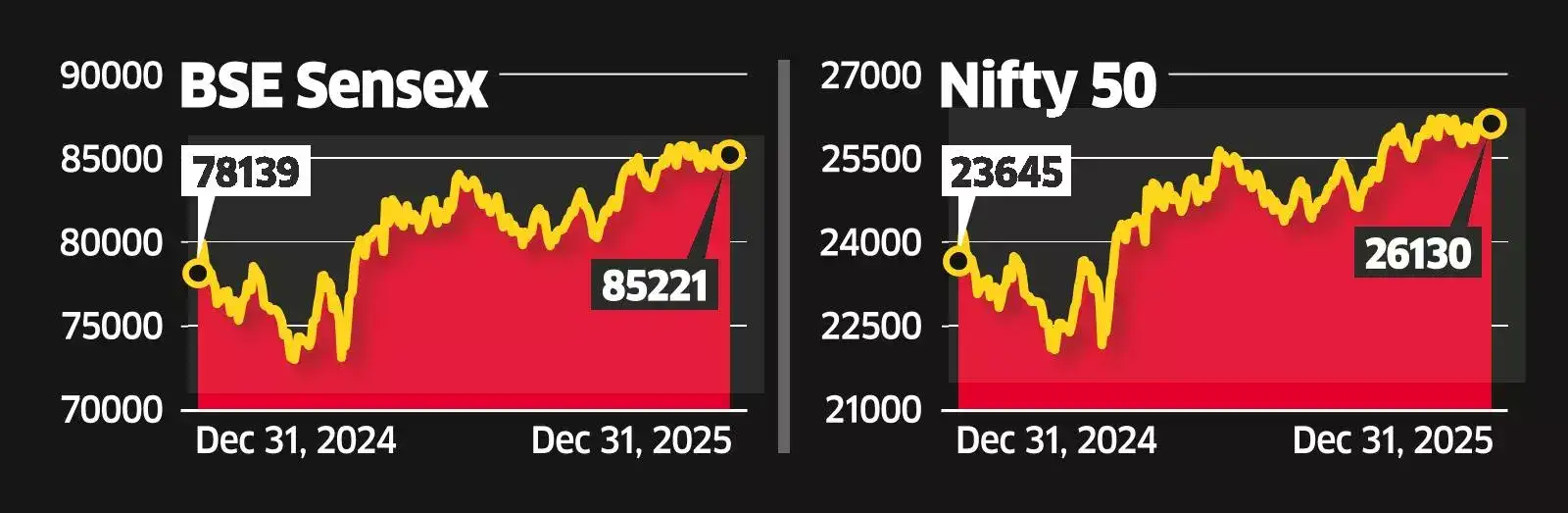

The stock market ended 2025 on a buoyant note on Wednesday - the last day of the year's trading, with both indices gaining up to 0.7%.

In 2025, Nifty, comprising blue-chips, gained about 10.5% while the broader market remained under pressure. The Nifty Mid-cap 150 rose 5.4% but the Nifty small-cap 250 dropped 6% in the same period.

A majority of the 31 stock market participants, including fund managers and brokers, polled by ET on the equity outlook, said the Sensex and Nifty are likely to gain between 8% and 14% in 2026. More than half the poll participants said the Nifty could advance to 28,000 to 29,500 levels, while the Sensex to touch 94,000-96,000 levels in 2026. Despite the drop in various small-cap stocks in 2025, fund managers prefer large-caps and mid-caps in that order.

Agencies

Agencies

Fund managers prefer large-and mid-caps in spite of a drop in small-cap stock prices

"Nifty is expected to deliver double-digit earnings in 2026, and the mid-cap earnings are expected to outpace large-cap earnings while the valuations are at a slight premium to their historical valuations," said Shibani Kurian, senior fund manager & head - Equity Research, Kotak Mutual Fund.

Mid-caps could provide opportunities in a bottom-up stock market, she said. "Small-cap stocks are trading at a significant premium to their historical valuations, and the earnings in the space are likely to be muted as well," said Kurian. "Investors should stay cautious in this segment."