The weakest labor market since 2011 has BofA asking, ‘Dude, where’s my job?’

"A lack of recovery in the jobs market and a slower U.S. economy are key risks to watch for 2026."

The weakest job market since 2011 is increasingly being framed not as a glitch, but as the new normal—one where growth roars and jobs barely move, leaving a generation asking, “Dude, where’s my job?”

Bank of America Research’s “Situation Room” note warned in mid-December that markets are priced for a robust 2026 even as hiring stalls and unemployment rises and recalled a now 25-year-old cult classic stoner comedy starring Ashton Kutcher and Seann William Scott to make its point.

The entry-level worker would be forgiven, in other words, for feeling about the job search the way Kutcher and Scott feel about their stolen wheels. (The screenwriter feels similarly about the show-business labor market, telling The Hollywood Reporter several weeks ago that he’d quit to become a therapist.)

”The job market has been weak this year,” wrote BofA’s Yuri Seliger and Sohyun Marie Lee, commenting on the double payrolls report showing weak job growth in October and November. “A lack of recovery in the jobs market and a slower U.S. economy are key risks to watch for 2026.”

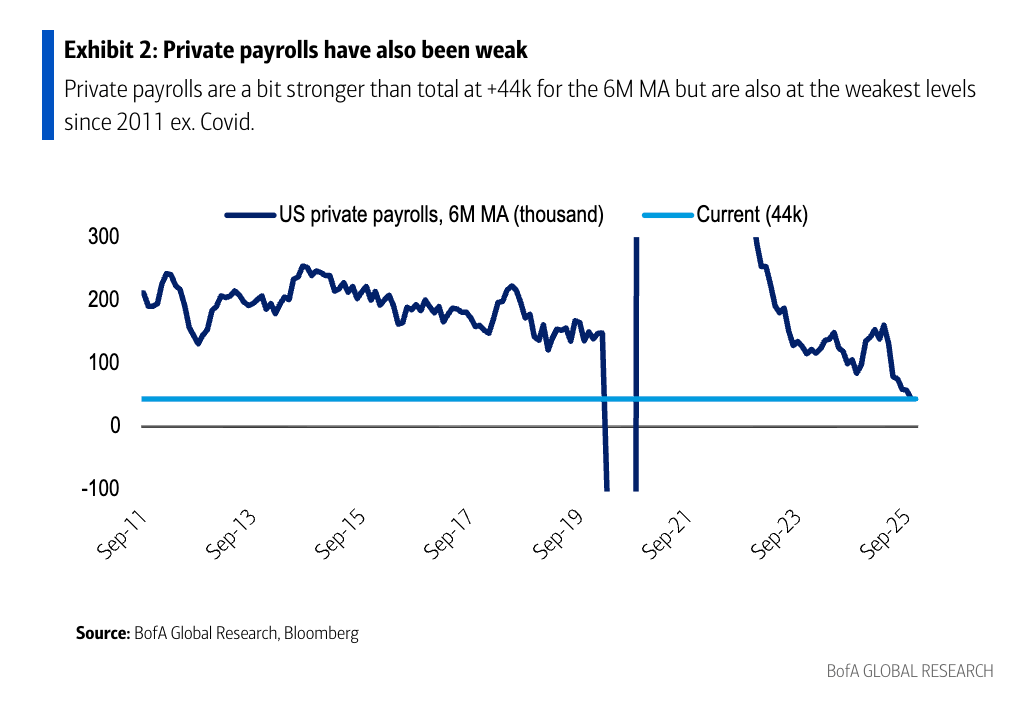

Seliger and Lee flagged what it called the weakest U.S. job market since at least 2011 (with the notable exception of the mass layoff wave from Covid), with monthly payrolls averaging just 17,000 over the past six months—by far the slowest pace of job creation since the global financial crisis. Private payrolls are only modestly stronger at 44,000 on a six‑month average basis, still at their weakest level in well over a decade, while broader U‑6 underemployment has climbed to 8.7% and job openings per unemployed worker have slumped to 1.0, both the softest since 2017.

Yet the Situation Room team also noted that credit spreads remain near cyclical tights and stocks near record highs, signaling that investors are still betting on a strong expansion in 2026. “A strong U.S. economy is likely not compatible with the absence of job growth,” they caution, warning that the lack of a labor‑market recovery is now one of the central risks to that bullish market narrative. The surprisingly strong GDP number for the third quarter, revealed after the BofA note was written, added new fuel to the fires of this argument.