Trump says US to 'run' Venezuela, tap its crude: Why it won't matter for India's oil bill

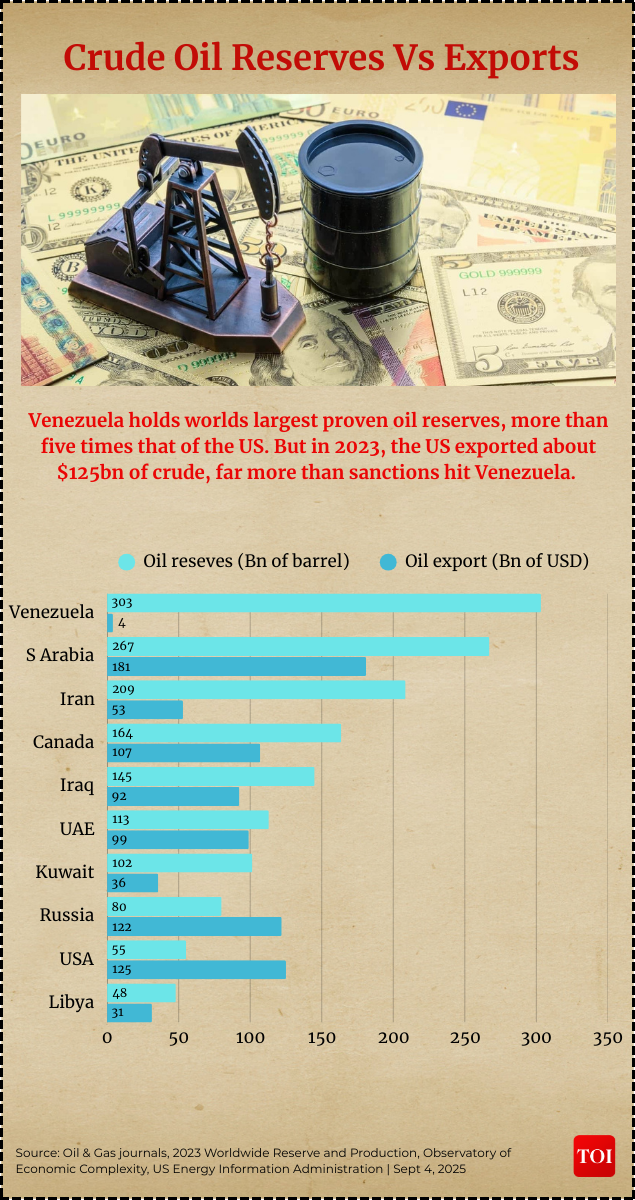

US President Donald Trump has said America is taking temporary control of Venezuela, aiming to tap its vast oil reserves. Despite holding the world's largest crude reserves, Venezuela's oil output is unlikely to see a significant boost for years due to political instability and decaying infrastructure. India's exposure remains minimal due to low trade and diversified sourcing.

India is watching developments in Venezuela with a mix of caution and concern as geopolitical churn around the oil-rich nation raises questions about global supply, price volatility and long-term energy security.Driving the newsPresident Donald Trump said on Saturday that the United States would take temporary control of Venezuela and tap its vast oil reserves for sale to other countries. Trump said he was “designating people” from his cabinet to oversee Venezuela but offered no further details.In a separate and unexpected remark, Trump suggested US troops could be deployed, saying Washington is “not afraid of boots on the ground.”

Trump Details Final Seconds Of Maduro's Capture: Fortress, Steel Doors, Gunfire & Failed Bid To Flee

Why it matters

The United States’ capture of Venezuelan President Nicolás Maduro has revived expectations that Venezuela’s oil sector could be “opened up” after years of isolation. The country holds the world’s largest proven crude reserves, yet produces only a fraction of what it once did.“Gaining control over Venezuelan crude oil lay at the core of the US operation. Venezuela holds about 18% of the world’s oil reserves, more than Saudi Arabia (around 16%), Russia (about 5–6%), or the United States (around 4%).

Venezuela alone has more crude oil reserves than the US and Russia combined,” the GTRI said in its report."We're going to have our very large United States oil companies... go in, spend billions of dollars, fix the badly broken infrastructure," President Donald Trump said at a Mar-a-Lago news conference said.

"We'll be selling large amounts of oil."

However, as per a Reuters report, Venezuela is unlikely to see a meaningful boost in crude output for years even if US oil majors invest billions of dollars.

Political instability, sanctions uncertainty, decaying infrastructure and legal risks continue to deter large-scale capital inflows.As one analyst told Reuters, American firms “won’t return until they know for sure they will be paid and will have at least a minimal amount of security,” underlining why regime change does not automatically translate into higher barrels.

Why Venezuela’s oil is hard to revive

Venezuela’s oil decline is structural, not cyclical.

Output has collapsed over the past two decades following nationalisation, underinvestment and the hollowing out of state oil company PDVSA. Infrastructure across the Orinoco Belt is badly degraded, skilled manpower has fled, and supply chains for equipment and diluents remain broken.Thomas O’Donnell, an energy and geopolitical strategist, told Reuters that “if Trump et al can produce a peaceful transition with little resistance, then in five to seven years there is a significant oil-production ramp up as infrastructure is repaired and investments get sorted out.”