Wall Street carries big expectations after best run since 2009

Markets kicked off the new year with a strong rally, mirroring 2025's trend. Investors saw significant gains across stocks, bonds, and commodities, driven by AI enthusiasm and easing inflation. However, this broad synchrony raises concerns about diversification's effectiveness and the sustainability of future returns, with some experts warning of anemic growth ahead.

The new year opened much as the last one ended, with markets rising, Wall Street confidence intact and little sign the forces that powered 2025 have run their course. What’s less clear is how long the cross-asset synchrony can last.

Global stocks gained on January’s first session, extending a run that carried through much of last year as enthusiasm around artificial intelligence, easing inflation and supportive central banks overwhelmed trade disputes, geopolitical strain and stretched valuations. For investors, it reinforced a simple lesson: taking risk paid.

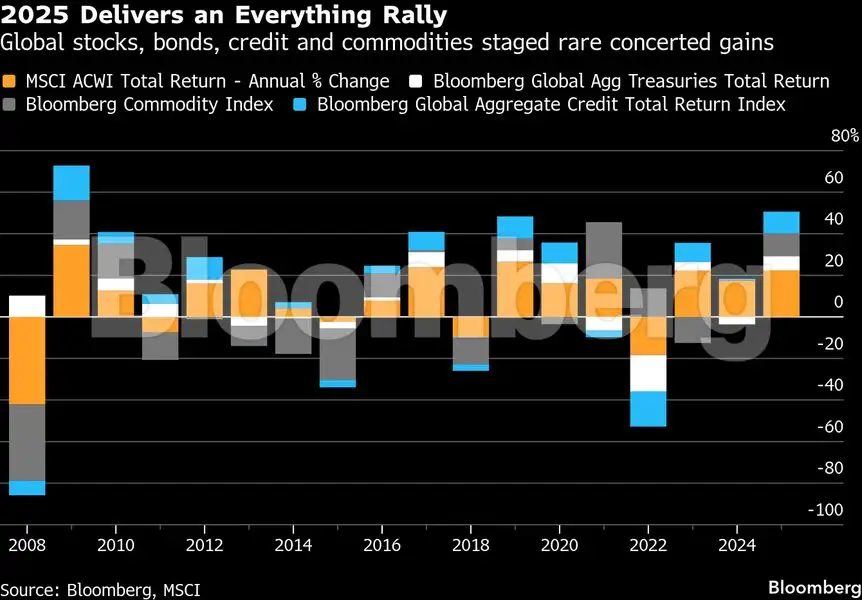

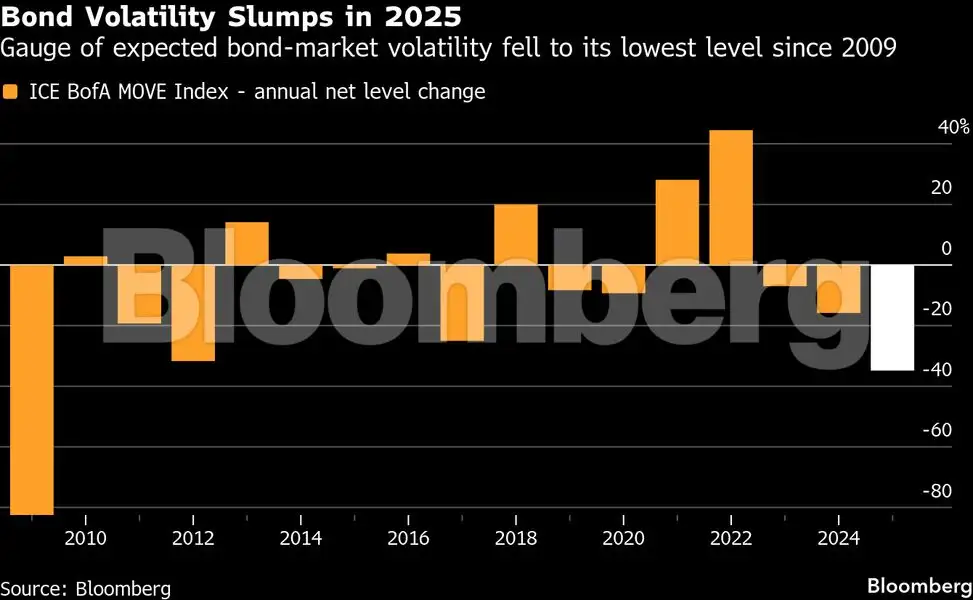

What made the year unusual, however, wasn’t just the strength of the rally but its reach across asset classes. Stocks and bonds rose together. Credit spreads tightened again. Commodities advanced even as inflation pressures eased. Gains were broad, sustained and unusually well aligned. By year-end, financial conditions had eased close to their loosest levels of 2025, underscoring rising valuations and a convergence of investor expectations around growth and AI.

Measured across global stocks, bonds, credit and commodities, 2025 delivered the strongest cross-asset performance since 2009 — a year marked by crisis-level valuations and sweeping policy intervention.

That alignment made diversification appear effortless — and in doing so, obscured how much depends on the forces that drove gains over the last 12 months remaining the same. When assets meant to offset one another move in the same direction, portfolios become less protected than they appear. Returns accumulate, but the margin for error narrows.

“We believe that 2025 has shown the risk of a diversification mirage,” said Jean Boivin, global head of the BlackRock Investment Institute. “This is not a story about diversification across these asset classes providing protection.”

Bloomberg

Bloomberg

As markets move deeper into 2026, the concern is not that last year’s rally was irrational, but that it may be difficult to repeat. Wall Street’s outlooks remain anchored to the same drivers — heavy AI investment, resilient growth and policymakers able to ease without reigniting inflation. Forecasts compiled by Bloomberg News from more than 60 institutions show broad agreement that those forces remain in place.

That optimism rests on a market that has already priced in a lot of good news.

Bloomberg

Bloomberg