Will the markets say cheese or continue to face January chills?

Indian equities historically struggle in January, with the Nifty and Sensex often seeing declines. However, analysts suggest this year might differ, potentially boosted by the upcoming Union Budget. Technical indicators point to potential gains if key levels are breached, while broader markets have shown more resilience. The Nifty closed slightly higher on the first trading day of 2026.

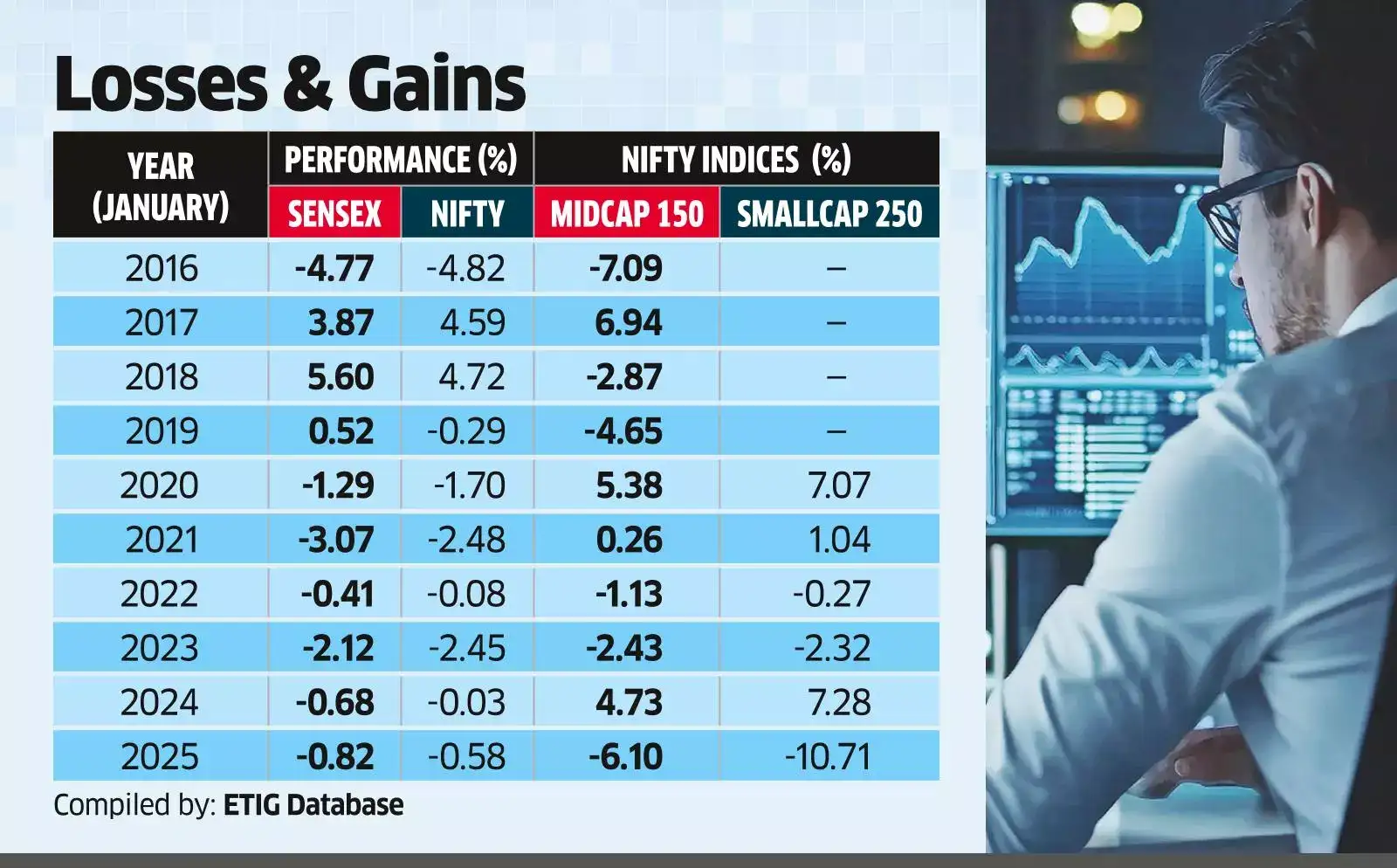

Mumbai: Indian equities have rarely found cheer in January. In the past decade, the Nifty has ended the month lower eight times and higher only twice, while the Sensex has managed gains on just three occasions.

"December used to be a good month for the markets based on seasonality trends, which was typically followed by a tepid January," said Sunny Agrawal, head of Fundamental Research at SBI Securities. "This time, December performance has been muted given the persistent foreign selling."

Both indices closed up to half a per cent lower last month. Agrawal said this time, the market could buck the weak seasonal trend this time ahead of the Union Budget in early February.

"If Nifty breaks above 26,250, there is room for gains up to 26,500 in the near term," said Ruchit Jain, head of Technical Research at Motilal Oswal Financial Services. "On the downside, the 50-day exponential moving average of 25,850 remains a crucial support."

Agencies

Agencies

If Nifty breaks above 26,250, there is room for gains till 26,500: Analysts

On Thursday, the first day of trading in 2026, the Nifty ended at 26,146.55, up 16.95 points ,or 0.1%.

In the past decade, the broader market has shown more resilience than the key indices in January.

The Nifty Midcap 150 has closed lower on six occasions and higher on four in this period, while the Nifty Smallcap 250 has ended lower three times in the last six years, including a steep 10.7% decline in 2025.